Rachel Reeves says she’s kept every manifesto promise on tax. That’s a technicality and a push.

Sure, the rates haven’t changed. But your tax bill has gone up anyway, and it will keep going up every year until 2031. The trick? The manifesto commitment was very focused on not increasing rates. It said nothing about at what point you pay those rates… aka the thresholds.

Take the median full-time worker earning £39k (according to the ONS). Their effective tax rate is 21.7% today. By 2031, after six years of 3% salary raises 1, they’ll pay 23.4%. That’s roughly £2,665 more in total tax over that period, even though the rates never moved.

That’s one salary band, but the impact is across the board. Data for more income levels is below.

Labour Party Manifesto 2024

Let’s go back and review: what was the specific manifesto commitment?

The Conservatives have raised the tax burden to a 70-year high. We will ensure taxes on working people are kept as low as possible. Labour will not increase taxes on working people, which is why we will not increase National Insurance, the basic, higher, or additional rates of Income Tax, or VAT.

The wording is precise: Labour commits not to increase ’the basic, higher, or additional rates of Income Tax,’ naming each rate explicitly. The word threshold is critically absent, as is any mention of the point at which income tax is applied.

Labour’s position is that freezing thresholds doesn’t count as raising taxes, it’s a matter of interpretation. The maths thoroughly disagrees.

When your salary rises with inflation but the thresholds stay frozen, more of your income gets pushed into higher tax brackets. You’re not paying higher rates, but you are paying more tax. This is fiscal drag, and it’s how frozen thresholds become a stealth tax rise.

Run the numbers and there’s nothing ambiguous about it: we’ll all pay more, every single year.

The Contradiction

Does Rachel Reeves really believe the commitment is being upheld? Who knows. But she’s holding onto the technicality.

Her comments during the Autumn Budget 2024 tell a different story. She said:

I have come to the conclusion that extending the threshold freeze would hurt working people. It would take more money out of their payslips. I am keeping every single promise on tax that I made in our manifesto, so there will be no extension of the freeze in income tax and national insurance thresholds.

A year later, she extended the freeze originally set to end in 2028 to 2031, adding three more years of fiscal drag, and claimed to have kept “every single one” of Labour’s manifesto commitments.

That directly contradicts what she implied last year. What’s changed? Nothing. The manifesto never mentioned thresholds in the first place, so she’s dancing on a semantic loophole.

On National Insurance, the position is even clearer. The IFS isn’t buying it. Their response to the 2025 Budget was blunt: extending the freeze on National Insurance thresholds:

breaches the government’s manifesto tax promise not to increase National Insurance.

The income tax position is muddy. The manifesto technically only promised not to raise “rates”, and the rates haven’t changed. But fiscal drag doesn’t care about semantics. The effect is identical to increasing rates, even if the mechanism isn’t.

The Impact

The income tax bands themselves haven’t moved:

| Band | Threshold | Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | Over £125,140 | 45% |

Labour promised not to change the rates (right column). They kept that promise. But they froze the thresholds (middle column), so as your salary grows, more income crosses those frozen lines.

Another way to visualise this impact is seeing tax as a % of total income.

The table below shows effective tax rates (income tax + NI as a % of total income) across different starting salaries, assuming a 3% annual increase:

Income Tax & NI as % of Salary

| Starting Salary | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Change |

|---|---|---|---|---|---|---|---|---|

| £10,000 | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | +0.0pp |

| £12,570 | 0.0% | 0.9% | 1.8% | 2.7% | 3.6% | 4.4% | 5.2% | +5.2pp 2 |

| £20,000 | 11.9% | 12.5% | 13.0% | 13.6% | 14.1% | 14.7% | 15.2% | +3.3pp |

| £30,000 | 18.6% | 19.0% | 19.4% | 19.7% | 20.1% | 20.4% | 20.8% | +2.2pp |

| £40,000 | 21.9% | 22.2% | 22.5% | 22.8% | 23.1% | 23.3% | 23.6% | +1.7pp |

| £50,000 | 24.0% | 24.4% | 24.9% | 25.4% | 25.9% | 26.4% | 26.8% | +2.8pp |

| £65,000 | 28.1% | 28.5% | 28.9% | 29.3% | 29.6% | 30.0% | 30.3% | +2.2pp |

| £80,000 | 30.7% | 31.0% | 31.3% | 31.6% | 31.9% | 32.2% | 32.5% | +1.8pp |

| £100,000 | 33.0% | 33.8% | 34.6% | 35.4% | 36.2% | 36.9% | 37.8% | +4.8pp |

| £125,000 | 39.3% | 39.5% | 39.7% | 39.9% | 40.1% | 40.3% | 40.5% | +1.2pp |

| £150,000 | 40.6% | 40.8% | 40.9% | 41.1% | 41.3% | 41.5% | 41.6% | +1.0pp |

| £200,000 | 42.2% | 42.3% | 42.5% | 42.6% | 42.7% | 42.8% | 43.0% | +0.8pp |

The pattern is clear: lower earners face the steepest proportional increases. A £20k worker sees their effective tax rate jump 3.3 percentage points; a £200k earner just 0.8pp. Worse still, it’s lower and middle income families who’ll be hit hardest by the frozen child benefit (tapered from £60k) and childcare (removed above £100k) thresholds as salary growth pushes them into those zones. Labour promised they wouldn’t hurt working people. The maths says they’re getting squeezed from both sides.

Note: this table doesn’t account for additional impact from child benefit and free childcare thresholds. 3

The Scale

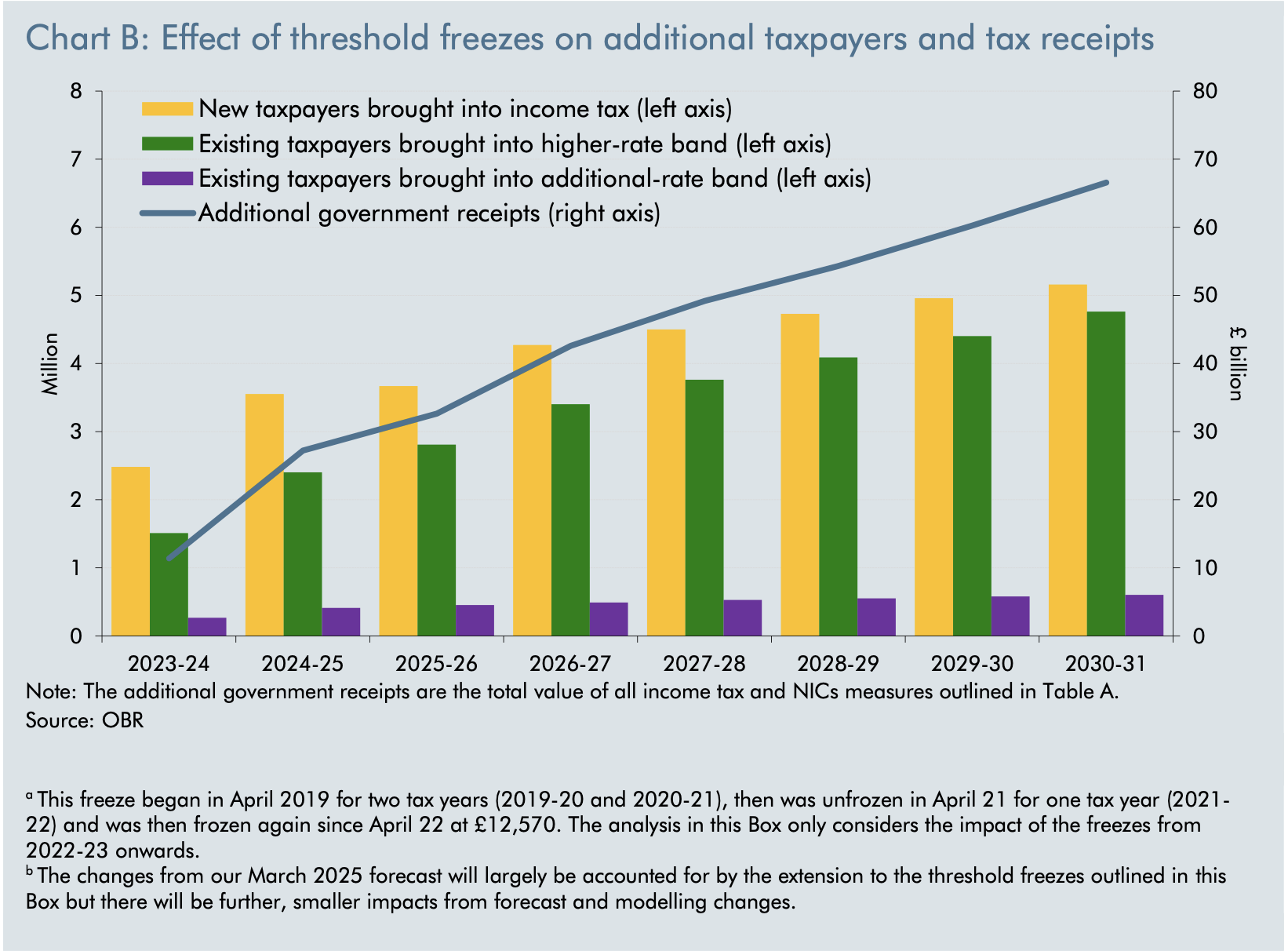

The Office for Budget Responsibility (OBR) doesn’t deal in semantic games. Their projections are blunt: by 2030-31, the threshold freeze will:

- Pull 5.1 million people into paying income tax for the first time

- Push 4.7 million existing taxpayers into the higher-rate (40%) band

- Raise an extra £52 billion annually for the Treasury

The blue line tells the story: additional government receipts climbing from £15 billion in 2023-24 to nearly £67 billion by 2030-31. That’s £52 billion more in annual tax revenue without changing a single rate.

So when Rachel Reeves says she’s kept every manifesto promise on tax, she’s technically correct. The rates haven’t budged. But 5.1 million new taxpayers and 4.7 million workers dragged into higher bands will pay thousands more by 2031, simply because the thresholds stayed frozen.

I get it, tax rises were inevitable and had to come from somewhere. But there’s a difference between difficult decisions and semantic games. The manifesto promised to protect working people from tax increases, yet the freeze hits lower and middle earners hardest, with proportional increases significantly more than those on higher incomes. If that commitment couldn’t be kept, own it. Don’t hide behind word games about rates versus thresholds and claim promises were honoured.

The word “threshold” never appeared in the manifesto. That omission will raise £67 billion annually by 2030-31.

The 3% annual increase assumption aligns with typical inflation-linked pay rises and sits between the 1% cap era (2013-2017) and recent catch-up awards (5-5.5%), making it a reasonable long-term projection. ↩︎

£12,570 starter shows the largest proportional increase, they start at the personal allowance threshold, so even small salary growth makes them a taxpayer. ↩︎

The High Income Child Benefit Charge starts at £60,000; free childcare eligibility ends at £100,000. Both are frozen. As more families drift into these zones through salary growth alone, they face effective tax rates far higher than the tables above suggest, losing benefits worth up to £2,501 annually (for two children) or £10,000+ in childcare support, while rates technically stay unchanged. ↩︎